Articles

Why Crypto Trends: The Hidden Drivers of Momentum

June 25, 2025

“The trend is your friend except at the end where it bends.” – Ed Seykota

Among speculative asset classes, assets that perform well often continue to do so, at least for a time. But few markets display momentum as powerfully, persistently, and profitably as crypto. Here’s why.

1. Fundamentals Are Elusive

Fundamentals like earnings, cash flows, and dividends provide valuation anchors in equities or fixed-income securities. However, these anchors are often absent or ambiguous in digital asset markets. How do you value a governance token that may generate cash but retains it in a treasury rather than distributing it? Is Bitcoin an equity, a currency, or a commodity?

Some utility-based models (e.g., MV=PQ) attempt to value assets based on transaction volume or monetary velocity. But these frameworks remain highly theoretical, especially for assets like Bitcoin, whose real-world use case has evolved more as a store of value (“digital gold”) than as a medium of exchange.

With no clear valuation anchor, price is more frequently driven by sentiment, narratives, and flows - perfect conditions for momentum to thrive. If there is no strong reason to fade a trend on valuation grounds, traders are more inclined to chase it.

2. Micro Fundamentals Are Often Reflexive

Some altcoins do have equity-like metrics, especially in DeFi: TVL, transaction volume, burn rates, and buybacks. But these indicators are often reflexive or at least circular, shaped more by price action than any underlying utility.

Take Hyperliquid: in bullish markets, platform volumes rise, token prices increase, revenues fund more aggressive buybacks. Higher prices also increase the value of potential airdrops, kickstarting a secondary flywheel, drawing in more users, boosting platform metrics, driving more buybacks, and reinforcing the uptrend. In downturns, the cycle reverses: activity dries up, buybacks shrink, and the token falls. Because these metrics rise and fall with market sentiment, they don't offer a stable foundation for valuation. This makes it difficult to say whether the token is "expensive" at $50 or "cheap" at $10 without contextualizing the broader market cycle.

This differs from traditional markets, where fundamentals like revenue or sales typically exist independent of stock performance. In crypto, what appears fundamental is often downstream of price behavior.

3. Reflexivity: When Price Becomes the Story

In digital assets, price moves not only impact fundamentals but can often spark narratives, not the other way around. This dynamic echoes George Soros’ theory of reflexivity: where market participants’ beliefs - as reflected in price - influence fundamentals, which then reinforce those beliefs (again, reflected in price). Crypto is a textbook case.

Bitcoin’s journey from a fringe asset to an institutional darling illustrates this well. As its market cap grew, its volatility fell, and Bitcoin ultimately became acceptable to institutions. This led to ETF approvals and endorsements from firms like BlackRock, creating further buying pressure, greater legitimacy, and a reflexive feedback loop.

4. Speculation and Meme Culture

Tokens like DOGE, PEPE, and BONK derive value almost solely from attention. There is no pretension of even a vaguely rigorous valuation model, just pure speculative momentum.

Here, price action itself becomes the driver. As tokens rally, more traders “ape in,” chasing gains until the trend inevitably exhausts. In such markets, momentum isn’t just a side effect. It is the thesis.

5. Retail Dominance and Emotional Trading

Despite increasing institutional involvement, crypto remains highly sensitive to flows at the margin, resulting in an outsized impact by retail traders/investors. These traders are more susceptible to emotion: FOMO in bull markets, panic in downturns.

Retail-heavy markets often overshoot in both directions, creating exaggerated trends. In contrast, traditional markets - especially those dominated by value-driven institutions - see more mean reversion. The FTSE 100 is a good example.

That said, even traditional indices like the Nasdaq have in recent years become more momentum-driven, influenced by leveraged ETFs, 0DTE (Zero days to Expiry) options, retail platforms like Robinhood, and meme stock mania.

6. Leverage and Liquidations: Momentum’s Fuel

Crypto is one of the most leveraged asset classes in the world. Traders routinely use 5x to 100x leverage with perpetual futures. With stop losses and margin calls baked into the system, relatively small price moves can trigger cascading liquidations.

This creates a mechanical feedback loop: price drops → liquidations → more selling → deeper price drops. The inverse happens in rallies with short squeezes. These cascades sharpen trends, making them more persistent and, more importantly, exploitable by momentum strategies.

7. Macro Liquidity: The Tide That Lifts All Boats

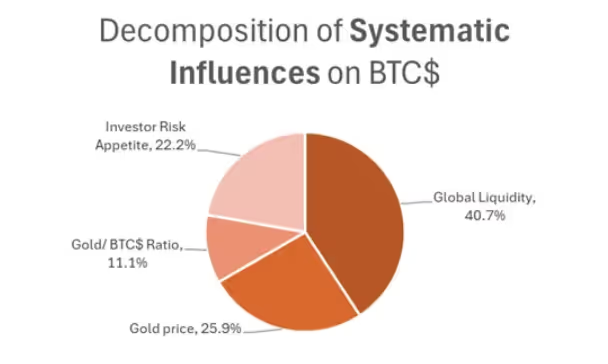

At the macro level, crypto is deeply tied to global liquidity—both central bank stimulus and broader credit creation. Michael Howell of CrossBorder Capital calls this the “Shadow Monetary Base”.

According to Howell's analysis, Bitcoin has shown ~41% sensitivity to global liquidity trends. In times of abundant liquidity, capital flows into crypto. When liquidity tightens, capital retreats, and valuations collapse.

These liquidity waves tend to be slow-moving (5–6 years), but they act as early-stage catalysts. Once the tide shifts, price gains reinforce narratives, drawing in more participants and compounding the trend. We saw this starting in late 2022, and Howell sees this peaking some time in 2026.

What’s unique now is that many dominant narratives are macro in nature: fears of dollar debasement, nations selling Treasuries for gold (or Bitcoin), and the recent “One Big Beautiful Bill Act” despite the initial enthusiasm around DOGE, are driving BTC dominance.

Quantifying It: The Hurst Exponent

Momentum can be quantified using the Hurst exponent, which measures the “memory” in a time series:

- H = 0.5 implies a random walk

- H > 0.5 indicates trending behavior

- H < 0.5 signals mean reversion

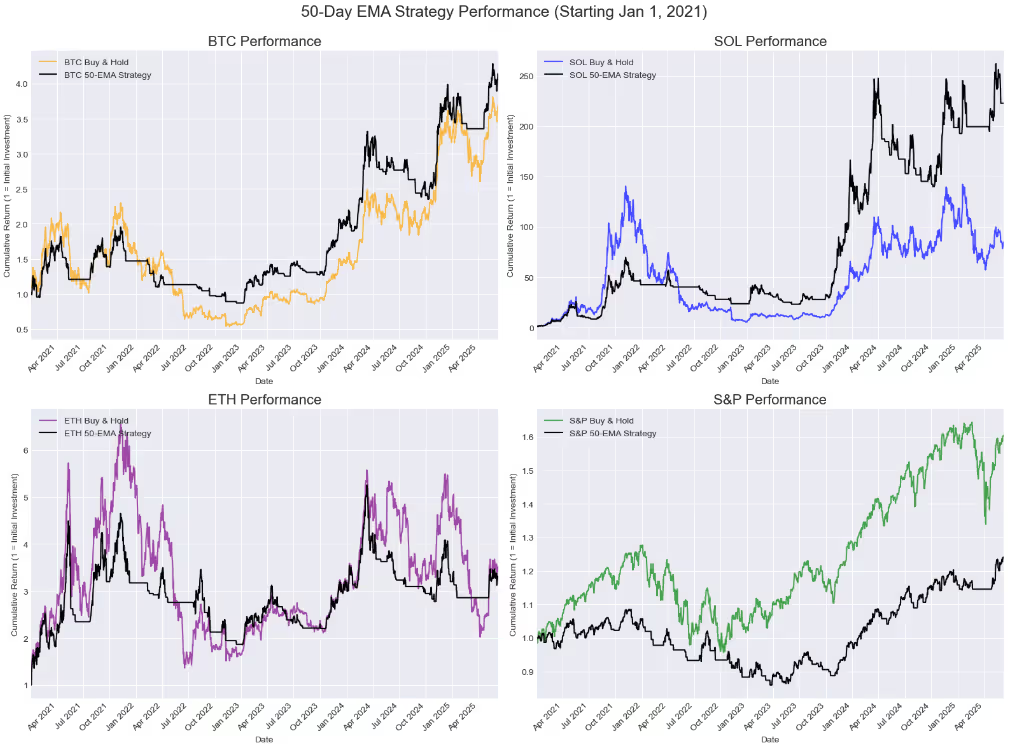

We calculate that between 2021 and 2024, BTC and SOL had Hurst exponents of 0.52 and 0.53, respectively - suggesting persistent trends for the reasons discussed. The S&P 500 scored 0.43, highlighting its more mean-reverting nature given the impact of institutional traders and the relevance of fundamentals, while ETH scored 0.45 ETH, largely reflecting a lack of compelling narratives (at least vs BTC and SOL) throughout the latter part of the period.

This trend-like behavior can be effectively captured through a systematic strategy. Below we compare a buy-and-hold approach for BTC, SOL, and the S&P against a simple momentum strategy that goes long when the daily close is above its own 50-day exponential moving average, an interval that we’ve empirically found to perform well at a high time frame. A highly trending asset would do well under this strategy by being exposed to the upward movements and avoiding the drawdowns. A mean-reverting asset would not, as it would be buying high on breakouts and selling into the pullbacks, continuously being ‘chopped up’ by the spread. Unsurprisingly, we find that BTC and SOL do well under this scenario and the S&P and ETH perform less well.

As institutional capital continues to enter the market, we may see these trend metrics moderate over time.

Conclusion: Momentum Isn’t Just a Feature - It’s Structural

Crypto’s structure - unclear fundamentals, reflexivity, meme-driven dynamics, retail dominance, high leverage, and sensitivity to liquidity - creates a market inherently prone to momentum.

In such an environment, strategies that identify and ride trends can exploit deep and persistent moves. However, understanding why momentum works and whether it can persist is key to navigating this volatile and reflexive asset class.